Times You May Need Help from Personal Injury Lawyers Brisbane

One of the most impactful times for anyone in Brisbane, and elsewhere in the world, is experiencing trauma caused by a severe personal injury. Having to deal with paperwork, insurance companies, and medical bills on top of your injury is beyond words. Trying to focus on your recovery becomes almost impossible when coping with all the stated stressors. Personal injury lawyers, Brisbane, is the help you need during this time.

Longer claim processes, not being compensated at all, or a reduced settlement are some of the scenarios you may experience when you decide to handle a personal injury claim by yourself. The proper claim handling to get the compensation you deserve become possible when you opt to ask for help from personal injury lawyers, Brisbane.

A better course of action is provided to you when you opt to hire personal injury lawyers, Brisbane to handle your personal injury claim. Here’s how and why:

Their understanding of everything related to the Personal Injury Claim Process

The personal injury claim process is a confusing and difficult field to navigate without legal help. A significantly lower payout or delayed process can result in a single misstep on your part.

Hiring a personal injury lawyer at the outset allows him to:

- Explain and help you understand the complexities of liability laws

- Gather information and facts pertinent to your case

- Deal with police officers and other law enforcement personnel

A claims process can be quickly expedited with the familiarity of an experienced lawyer in dealing with local courts. Your part in the process is to honestly and accurately describe the details of the accident to your lawyer. This honest disclosure on your part allows the lawyer to provide a smooth and seamless claim process experience.

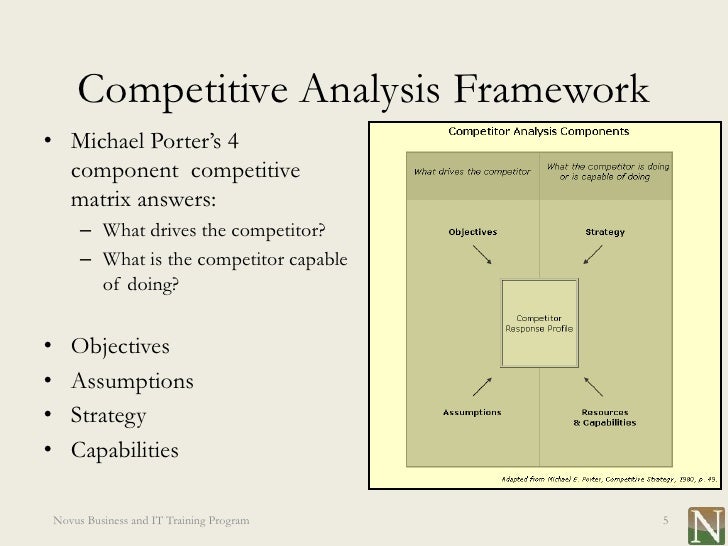

They are settlement agreement experts

Court trials are not often part of personal injury claims. The typical scenario for personal injury claims is reaching a settlement between an insurance company and you. A settlement that is agreeable to both parties is reached through skilful negotiations.

Negotiating with an insurance company needs legal skills. You may end up on the shorter stick of the deal should you decide to do it without legal help. It is in your best interests to let a professional and experienced injury lawyer handle the negotiation. A good settlement is likely to happen with help from a reputable personal injury lawyer.

They can represent you in court

A lawsuit is considered the last option when both parties fail to reach an agreement. While you can represent your interests in court, pitting yourself against a lawyer from the other party will prove disadvantageous to your case.

Unless you are a lawyer, the best chance for you to get rightfully compensated is to have a personal injury lawyer in your corner. Having a legal expert to represent your rights is the best way to match the expertise level of the other party.

They can expedite your claim

Delays such as procuring witness statements, legal paperwork, insurance red tape, and more can carry the personal injury claims process for months or years. Waiting for months on end for the payout while recovering from injuries is not a situation you want to be in.

Staying on top of the claim process to expedite it quickly needs legal help. Compensation can be quickly expedited with compensation lawyers in Brisbane negotiating on your behalf..